Nvidia Corp reported drop in Net Income in the second quarter 2023 by -72.37% to $ 656.00 millions, from the same quarter in 2022. NVDA Net Income second quarter 2023 Y/Y Growth Comment

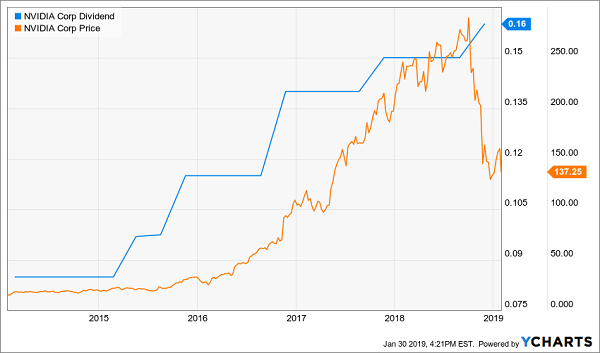

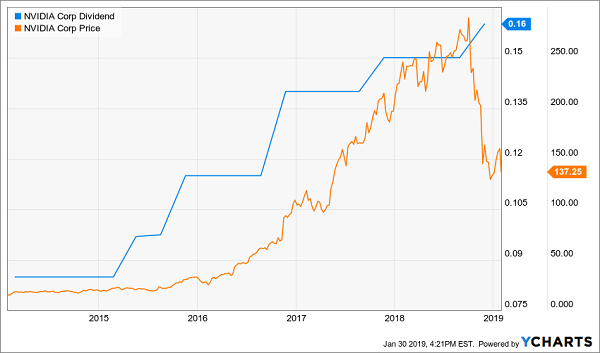

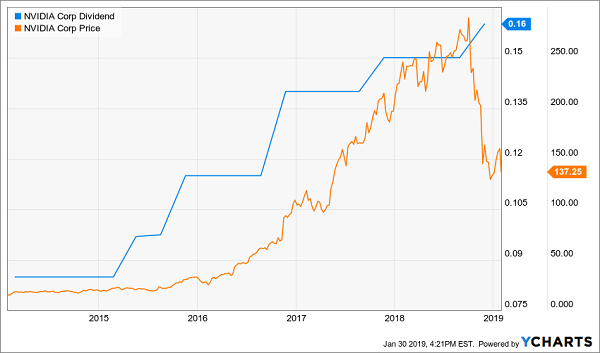

Income from Continued Operations Annual Growth. Please refer to the last column "Forex Rate" in the above table. * GuruFocus converts dividend currency to local traded share price currency in order to calculate dividend yield. * GuruFocus has an internal rule that if the most recent dividend payment frequency is at least 4 times a year, then the full year will be calculated according to the frequency of payment or the one-year time frame, whichever is stricter. NVIDIA Recent Full-Year* Dividend History Amount Dividend Yield % measures how much a company pays out in dividends each year relative to its share price. Payments to Suppliers for Goods and Servicesĭuring the past 13 years, the highest Dividend Payout Ratio of NVIDIA was 0.42. Other Cash Receipts from Operating Activities. Other Cash Payments from Operating Activities. Cash Received from Insurance Activities. Cash Receipts from Securities Related Activities. Cash Receipts from Operating Activities. Cash Receipts from Fees and Commissions. Cash Receipts from Deposits by Banks and Customers. Cash Payments for Deposits by Banks and Customers. Cash from Discontinued Operating Activities. Cash From Discontinued Investing Activities. Short-Term Debt & Capital Lease Obligation.  Other Liabilities for Insurance Companies. Long-Term Debt & Capital Lease Obligation. Inventories, Raw Materials & Components. Cash, Cash Equivalents, Marketable Securities. Accumulated other comprehensive income (loss). Accounts Payable & Accrued Expense for Financial Companies. Depreciation, Depletion and Amortization. Margin of Safety % (DCF Dividends Based). Margin of Safety % (DCF Earnings Based).

Other Liabilities for Insurance Companies. Long-Term Debt & Capital Lease Obligation. Inventories, Raw Materials & Components. Cash, Cash Equivalents, Marketable Securities. Accumulated other comprehensive income (loss). Accounts Payable & Accrued Expense for Financial Companies. Depreciation, Depletion and Amortization. Margin of Safety % (DCF Dividends Based). Margin of Safety % (DCF Earnings Based).

Float Percentage Of Total Shares Outstanding.